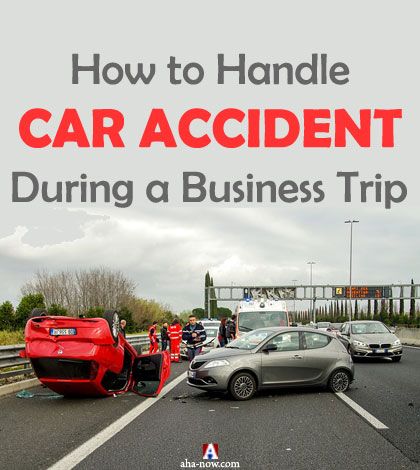

How to Handle Car Accident during a Business Trip

Table of Contents

Had a car accident? What should you do in that hour? If your car is damaged, then you may be able to make a claim against your personal or commercial insurance policy. For that, you should know about what specific actions to take on the accident spot and later so it helps in your insurance claim. This post will help you prepare yourself to handle such situations. ~ Ed.

Being away on a business trip has a number of perks such as being able to travel to a new place while staying in a nice hotel.

However, traveling on a business trip also comes with inconveniences such as delayed flights or misplaced luggage. What is even worse is the risk of being in a car accident during your business trip.

In case you encounter this unfortunate event, here are some tips on how to handle the situation. That is to make you aware of the immediate steps to take in the event of a car accident.

4 Tips to Handle Car Accident during a Business Trip

An accident is usually sudden and takes you by surprise. However, you can be better prepared to handle such situations if you know when and what to do. Here’s some information regarding handling car accidents that you may find handy and useful.

Safety First

Whether you are traveling for business or not, it is important to keep safety a priority.

Practice defensive driving at all times and make it a habit to be in top shape when you are behind the wheel. However, there are instances wherein road mishaps cannot be prevented. In these cases, it is best to always be prepared.

Thereby, whether you are driving a rental car or your company car, check the availability of early warning devices such as reflective triangles, in the car’s trunk.

Always bear in mind to have the vehicle’s registration and insurance certificate with you. Other essentials that should be in the glove compartment is a first aid kit, as well as a pen and paper where you will be able to easily jot down the necessary information.

Traffic Safety

In case of a car accident, immediately turn on your hazard lights, especially if you are able to.

Before inspecting your vehicle, it is best to move it off the roadway if possible, to prevent the risk of other accidents caused by your car as an obstruction.

Place reflective triangles in the direction of oncoming vehicles to indicate that hazard caused by the accident. This is the reason why early warning devices are important and should always be available in the trunk of your vehicle.

If you are able to do so, check all those involved in the accident, particularly if anyone needs immediate medical attention.

Police Report

If everybody is alright, the next step is to call the police. They are the best people who will be able to give an unbiased and detailed report of the accident.

The report coming from the police is an essential document mandatory for insurance or personal injury claims. Thus, it is important to note, the jurisdiction of the police department such as the state or town where the accident happened.

You can also exchange information, such as name and contact details, with the other drivers involved in the accident. Take note also of the license plate numbers, make, and model of the vehicles involved in the crash.

If possible, record the names and contact information of witnesses. It is best if you will be able to take pictures of the scene to document even the weather and road conditions when the accident happened. Apart from the pictures, panoramic video footage will be most beneficial.

Insurance Claim

A detailed description of the accident will greatly help with the insurance claim. Thereby, it is best to include details such as the date, time, location, weather, and road conditions to name a few.

It will also be helpful to note the behavior of all drivers involved in the accident, as well as the condition of the vehicles.

There are normally two sides verified in an accident and these are either ‘at fault’ or ‘not at fault’. The cause of the accident is where the fault lies, and this becomes the basis of which insurance policy should respond.

In the same manner, the type of vehicle involved in the accident can also be a factor to determine which insurance policy is involved. For instance, if you are using a rented car to drive yourself to the airport, you may need to use your personal policy.

Additional process for a car accident during a business trip

However, if you are using a company vehicle, then the claim would most likely be against a commercial policy.

An investigation will be held by the insurance policy identified to cover the damages of the accident. It is in this investigation where the police report and other accounted for details of the accident will come into play.

The insurance company will want to review even sworn statements made by witnesses if any. In instances wherein a personal policy is insufficient to cover the accident costs of an employee while on a business trip, the company may be held responsible.

If such is the case, it is best to enlist the services of a car accident lawyer. In this manner, there is a greater chance for you to get compensation for your loss of earnings, medical bills, and property damage to name a few.

Nevertheless, there is a great possibility that your employer will most likely file for your claim if you are traveling for business. In this case, you may want to confirm with your HR department regarding the necessary procedures and requirements that need to be accomplished. Sometimes, a police report that you submit to your HR will be sufficient on your end with the rest of the process will be handled by the company.

Other Car Accident Related Insurance Policies

There are instances wherein the accident does not involve you, but your car breaks down. In these cases, a roadside assistance insurance coverage can greatly help you in paying for towing services and labor costs of repairing your vehicle.

An umbrella insurance may go beyond your car and home insurance policies. This can be sufficient to protect you from an overall negative impact of unforeseen circumstances.

There is also a personal injury protection insurance. It covers medical expenses and lost wages, regardless of who is at fault in the vehicular accident.

Filing for a claim is usually a manual and tedious process. But thanks to the advantages of modern technology, there are already online avenues where insurance claims can be filed.

Wrapping Up

Whenever you are traveling, either for vacation or for a business trip, keep safety as your top priority.

However, there are instances wherein unfortunate incidents such as a car accident cannot be prevented. In case this happens to you while you are on a business trip, follow the tips above to stay on top of the situation.

Being aware of the immediate steps to take in the event of a car accident will greatly help you in that hour of difficulty. Also, proper knowledge of the insurance policies can help you assess and file your insurance claims.

Over to you

Do you have any other tips to handle a car accident? Share in the comments.

Disclaimer: Though the views expressed are of the author’s own, this article has been checked for its authenticity of information and resource links provided for a better and deeper understanding of the subject matter. However, you're suggested to make your diligent research and consult subject experts to decide what is best for you. If you spot any factual errors, spelling, or grammatical mistakes in the article, please report at [email protected]. Thanks.